Ayushman Card gives families financial confidence during medical emergencies 🩺💙. This government health scheme reduces hospital bills, expands cashless treatment, and protects savings. Understanding eligibility, benefits, and enrollment helps citizens use quality healthcare without fear, paperwork stress, or unexpected expenses across India nationwide for all eligible households today and tomorrow too

🆔 What Is the Ayushman Card?

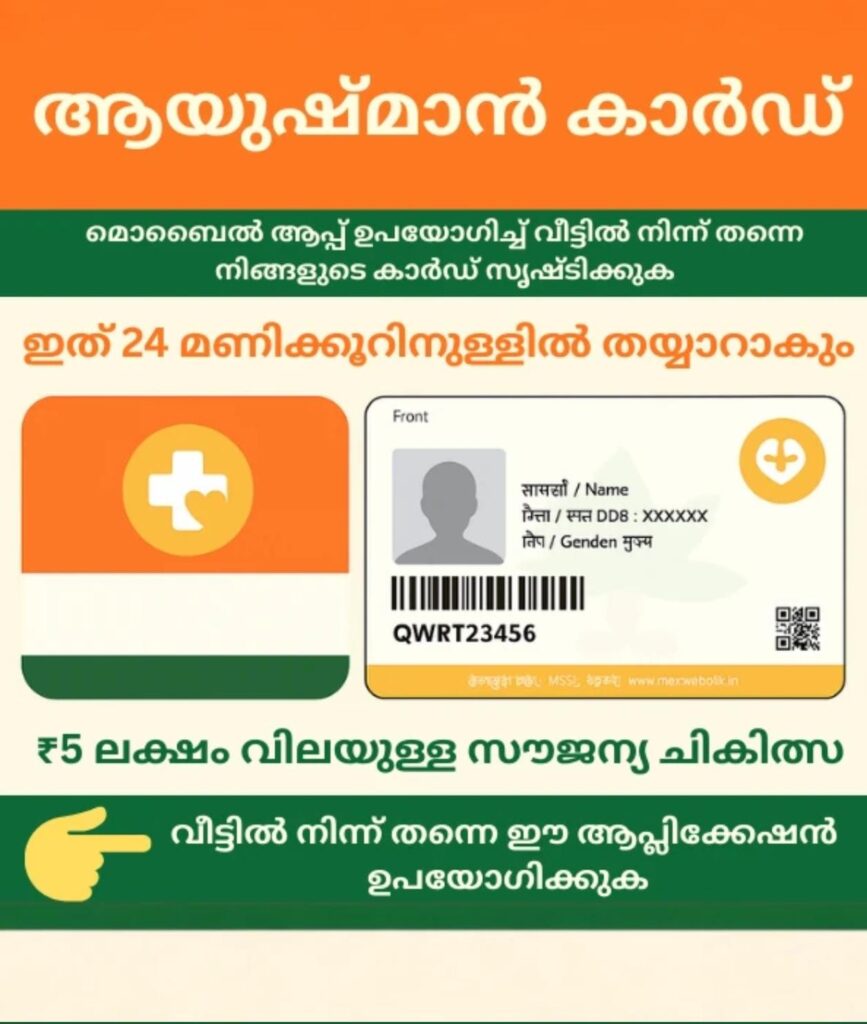

The Ayushman Card, issued under Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (PM-JAY), is a government health insurance card that offers cashless hospitalization to eligible families. It aims to ensure affordable healthcare access, covering major treatments at empaneled public and private hospitals

💳 Key Benefits of Ayushman Bharat Health Insurance

With the Ayushman Card benefits, families receive coverage up to ₹5 lakh per year per household for secondary and tertiary care. It includes surgeries, medicines, diagnostics, and pre- and post-hospitalization expenses, reducing the burden of medical bills significantly

🧾 Who Is Eligible for the Ayushman Card?

Eligibility depends on SECC data, income status, and socio-economic criteria. Rural and urban poor, daily wage workers, and vulnerable groups qualify. Checking Ayushman Card eligibility online helps families confirm benefits without agents or middlemen

🏥 Cashless Treatment at Empaneled Hospitals

The card enables cashless treatment at thousands of empaneled hospitals across India. Beneficiaries only need to show the card or Aadhaar to receive treatment, ensuring paperless healthcare and faster admissions during emergencies

📝 How to Apply for an Ayushman Card

Citizens can apply through Common Service Centers (CSC) or official portals. Aadhaar verification and basic details are required. Once approved, the Ayushman health card can be downloaded digitally and used immediately

📱 How to Check Ayushman Card Status Online

Using mobile numbers or Aadhaar, beneficiaries can check Ayushman Card status online. This transparency helps families track approvals, hospital eligibility, and coverage details anytime, anywhere

🛡️ Diseases and Treatments Covered

The scheme covers thousands of procedures including heart surgery, cancer treatment, dialysis, orthopedic care, and maternity services. This wide coverage makes Ayushman Bharat one of the largest health insurance schemes in India

⚠️ Common Myths About Ayushman Card

Many believe it’s only for government hospitals or limited treatments. In reality, private hospitals are included, and no premium is charged. Awareness helps beneficiaries fully utilize the scheme without confusion

👨👩👧 How Ayushman Card Supports Families

By removing upfront payments, the scheme protects families from debt and asset sales. It ensures dignified healthcare, timely treatment, and peace of mind, especially for senior citizens and low-income households

🌱 Long-Term Impact on Indian Healthcare

Ayushman Bharat strengthens healthcare infrastructure, increases hospital accountability, and promotes preventive care. It is a major step toward universal health coverage, improving outcomes and trust in public health systems

The Ayushman Card is more than insurance; it is health security for families 🛡️💚. By checking eligibility, enrolling correctly, and using empaneled hospitals, citizens can access cashless healthcare, avoid debt, and protect savings. Awareness ensures timely treatment, dignity, and long-term wellbeing for every eligible household across India today