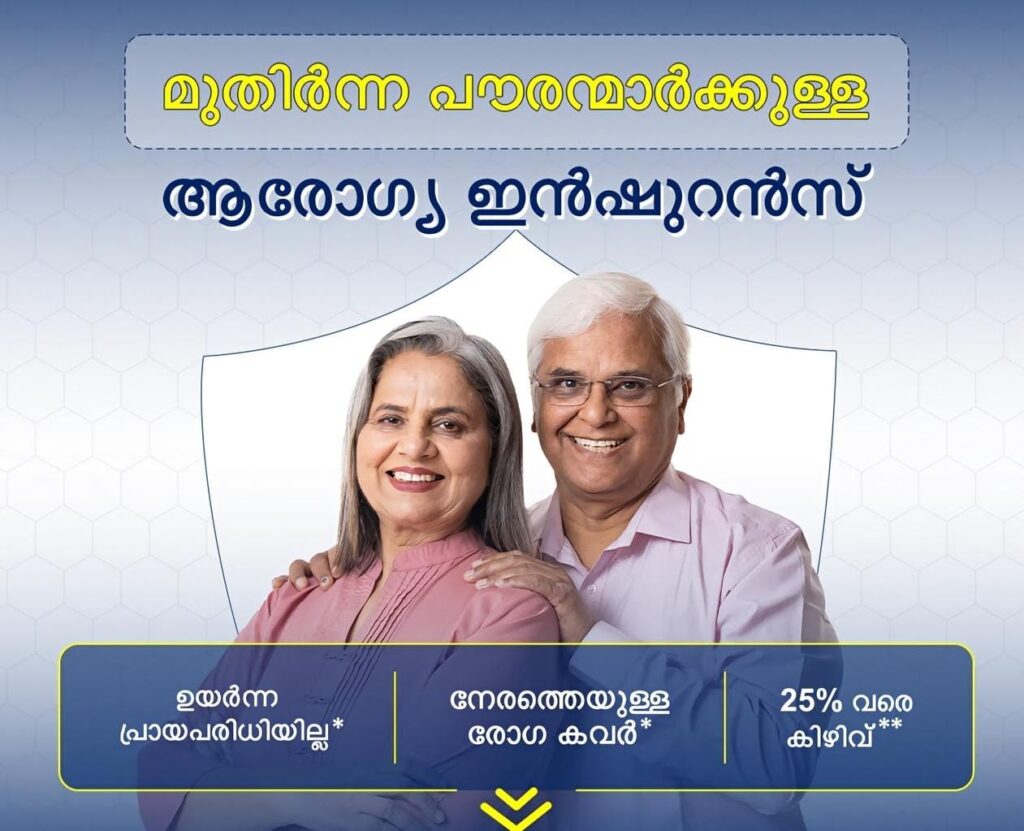

As people grow older, health becomes a top priority. Medical expenses tend to rise with age, and even a small hospital visit can be financially stressful. This is why health insurance for senior citizens plays a crucial role in ensuring peace of mind, dignity, and quality healthcare during the golden years of life.

🏥 What Is Senior Citizen Health Insurance?

Senior citizen health insurance is a specially designed medical insurance plan for people usually aged 60 years and above. These policies cover hospitalization costs, medical treatments, and sometimes even pre-existing diseases. The goal is to reduce the financial burden on elderly individuals and their families.

💊 Why Health Insurance Is Essential for Older Adults

With advancing age, the risk of chronic illnesses such as diabetes, heart disease, arthritis, and hypertension increases. Health insurance helps senior citizens:

💙 Manage rising medical expenses

💙 Access quality healthcare without delay

💙 Reduce dependency on family members

💙 Get timely treatment during emergencies

💙 Maintain financial independence

📋 Common Coverage Provided in Senior Citizen Plans

Most senior citizen health insurance policies include:

🛏️ Hospitalization expenses

🩺 Doctor consultation and diagnostic tests

💉 Pre and post-hospitalization costs

❤️ Treatment for age-related illnesses

🧾 Cashless treatment at network hospitals

Some advanced plans may also include home healthcare and annual health check-ups.

👴 Who Can Apply for Senior Citizen Health Insurance?

These plans are ideal for:

✔️ Individuals aged 60 years and above

✔️ Retired professionals

✔️ Elderly parents without employer insurance

✔️ Senior citizens with limited savings

Many insurers now offer simplified medical check-ups or even no medical tests for certain age groups.

💰 How Senior Citizen Insurance Saves Money

Without insurance, a single hospital stay can drain years of savings. Health insurance helps by:

💵 Covering major medical expenses

💵 Offering tax benefits under applicable laws

💵 Reducing out-of-pocket costs

💵 Protecting retirement funds

This financial security allows senior citizens to focus on recovery rather than expenses.

🌍 Government and Private Options Available

Senior citizens can choose from government-backed health schemes as well as private insurance plans. Government schemes often offer affordable premiums, while private plans provide wider coverage and faster services. Choosing the right plan depends on health condition, budget, and coverage needs.

🛡️ Tips to Choose the Right Plan

Before selecting a policy, seniors should check:

🔍 Coverage for pre-existing diseases

🔍 Waiting period details

🔍 Hospital network availability

🔍 Claim settlement ratio

🔍 Customer support quality

A well-informed decision ensures long-term benefits.

✅ Final Thoughts

Health insurance for senior citizens is not an expense—it is an investment in health, dignity, and independence. With the right insurance plan, elderly individuals can enjoy their golden years with confidence, knowing that quality healthcare is always within reach.

SEOKOK Apps, Live Links & Product Reviews

SEOKOK Apps, Live Links & Product Reviews